- Financial Management System

Eliminate reporting errors, make accurate choices

Stop letting your financial data scatter across Excel spreadsheets. With Inlab’s Financial Management System, every task from bookkeeping to analytical reporting lives in one unified platform. Real-time visibility, automated operations, and full compliance with local accounting standards are now just a click away.

No Risk of Misinformation

Full Control Over Financial Flow

Less Guesswork, More Accuracy

Audit-Ready System

- Why?

Make every financial decision on a system-driven foundation

Say goodbye to disconnected applications, inconsistent reports, and delayed data flows. With Inlab’s Financial Management System, operations are streamlined, reports are precise, and your team can focus on strategic work.

Automated Accounting Operations

Accounts payable, accounts receivable, and general-ledger activities are executed automatically by the system, saving both time and human resources.

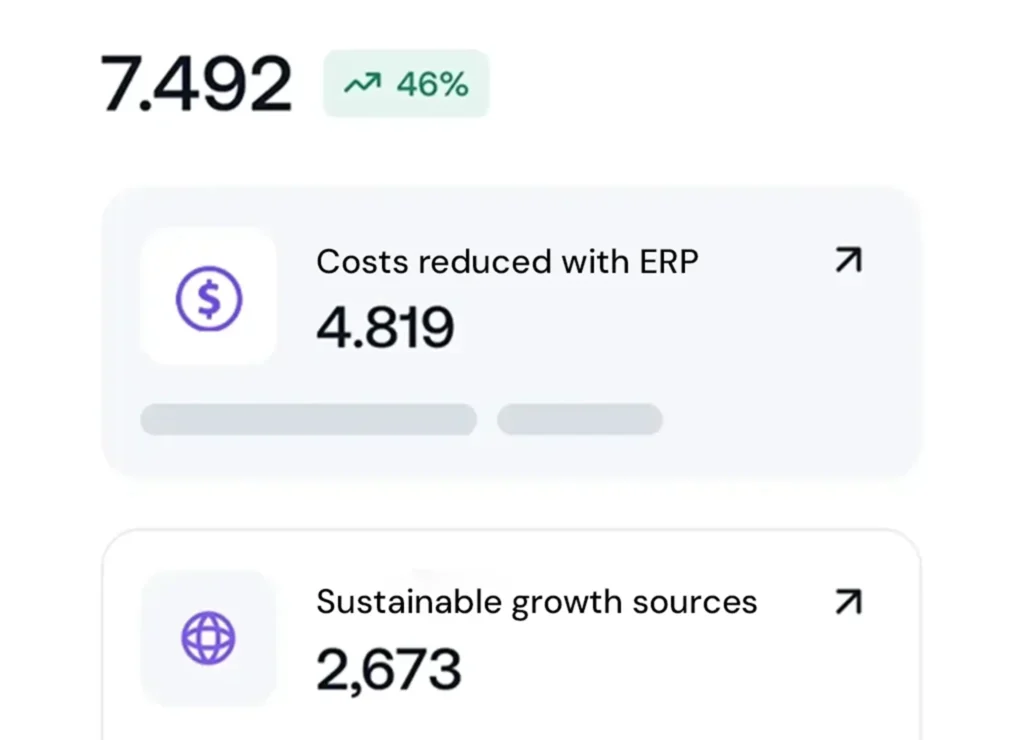

Real-Time Analytics & Dashboards

Every payment, budget, expense, and revenue stream is reflected instantly. KPI indicators and visual reports accelerate decision-making.

Multi-Dimensional Structure Support

Unify multiple legal entities, branches, currencies, and tax regimes on one platform and consolidate all reports seamlessly.

Full Regulatory Compliance

Your ERP system automatically adapts to U.S. tax laws, payroll regulations, GAAP accounting standards, government e-filing systems, and other compliance requirements.

Keep your financial reports both correct and easy to understand

Don’t let payment flows, profit-and-loss balances, or tax filings remain dispersed across different systems. With Inlab, bring all financial processes onto a single ERP platform fully visible, traceable, and ready for strategic decisions.

- FAQs

Frequently Asked Questions

FMS automates accounts payable and receivable, payment scheduling, general-ledger postings, budget monitoring, and period close. Source documents (e.g., purchase orders and invoices) trigger end-to-end transaction chains, while the system calculates currency differences, late-payment fees, and discounts automatically. Manual effort is drastically reduced and month-end close becomes much faster.

Yes. Your ERP system automatically adapts to U.S. tax laws, payroll regulations, GAAP accounting standards, government e-filing systems, and other compliance requirements. When legislation changes, Inlab supplies update packs so the system remains current and penalty-free.

Access is managed through role-based permissions, so employees see only what their role requires. Security features such as two-factor authentication and audit logs protect confidentiality and give full traceability of every action.

Absolutely. Our Financial Management System supports multi-entity, multi-currency structures and can be tailored to organisations operating with several branches or different currencies.

We structure and validate your existing data, then migrate it into the Financial Management System in the appropriate format. A step-by-step approach prevents data loss and minimises difficulties during the transition.